.png)

.png)

FinSight delivers enterprise-level DCF valuation, stress testing, and credit analysis in one integrated platform. Make faster, more confident lending decisions without the spreadsheet complexity.

Comprehensive tools built specifically for debt structuring, credit analysis, and institutional-grade DCF modeling

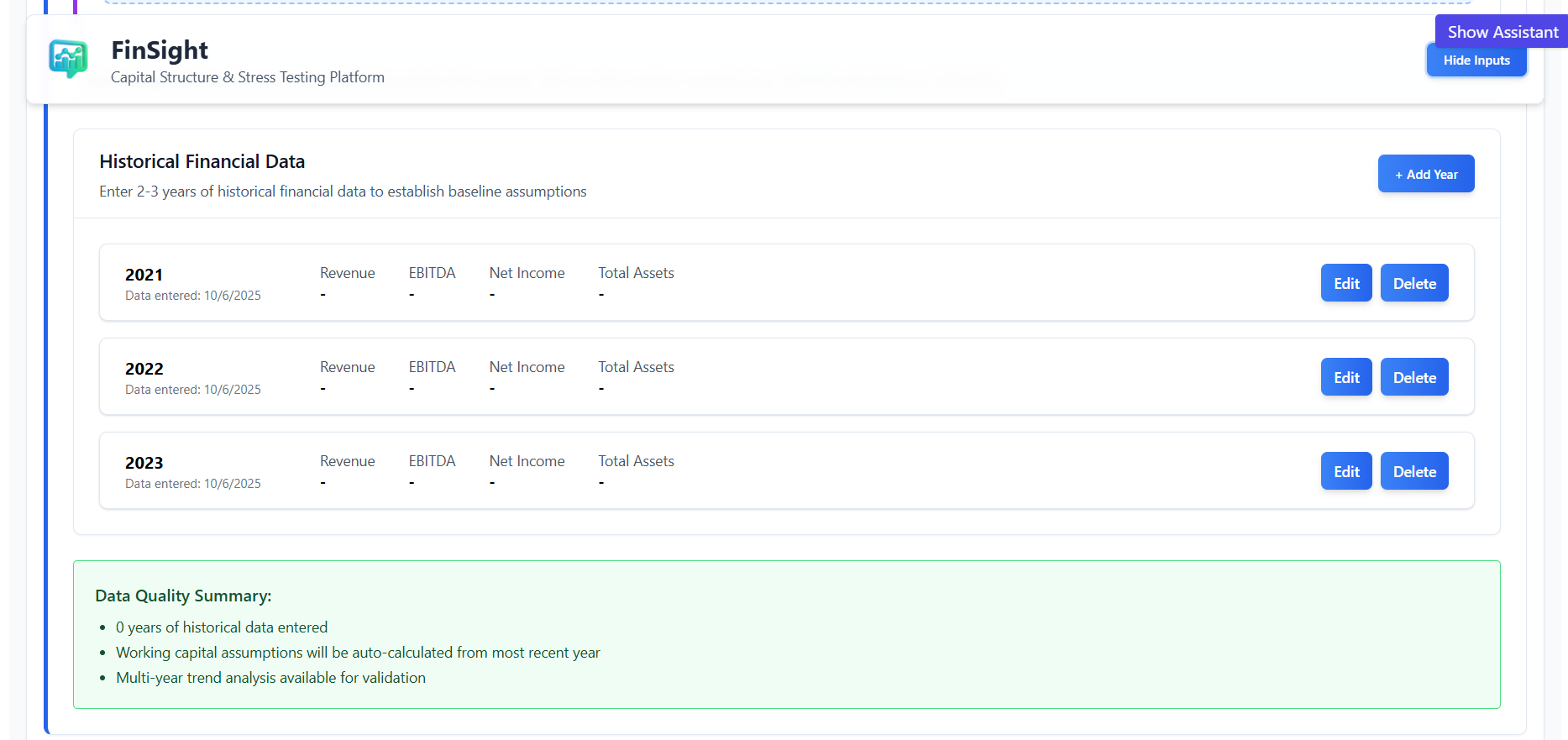

Import historical data and generate 5+ year projections with sophisticated FCFF calculations, working capital modeling, and debt amortization schedules.

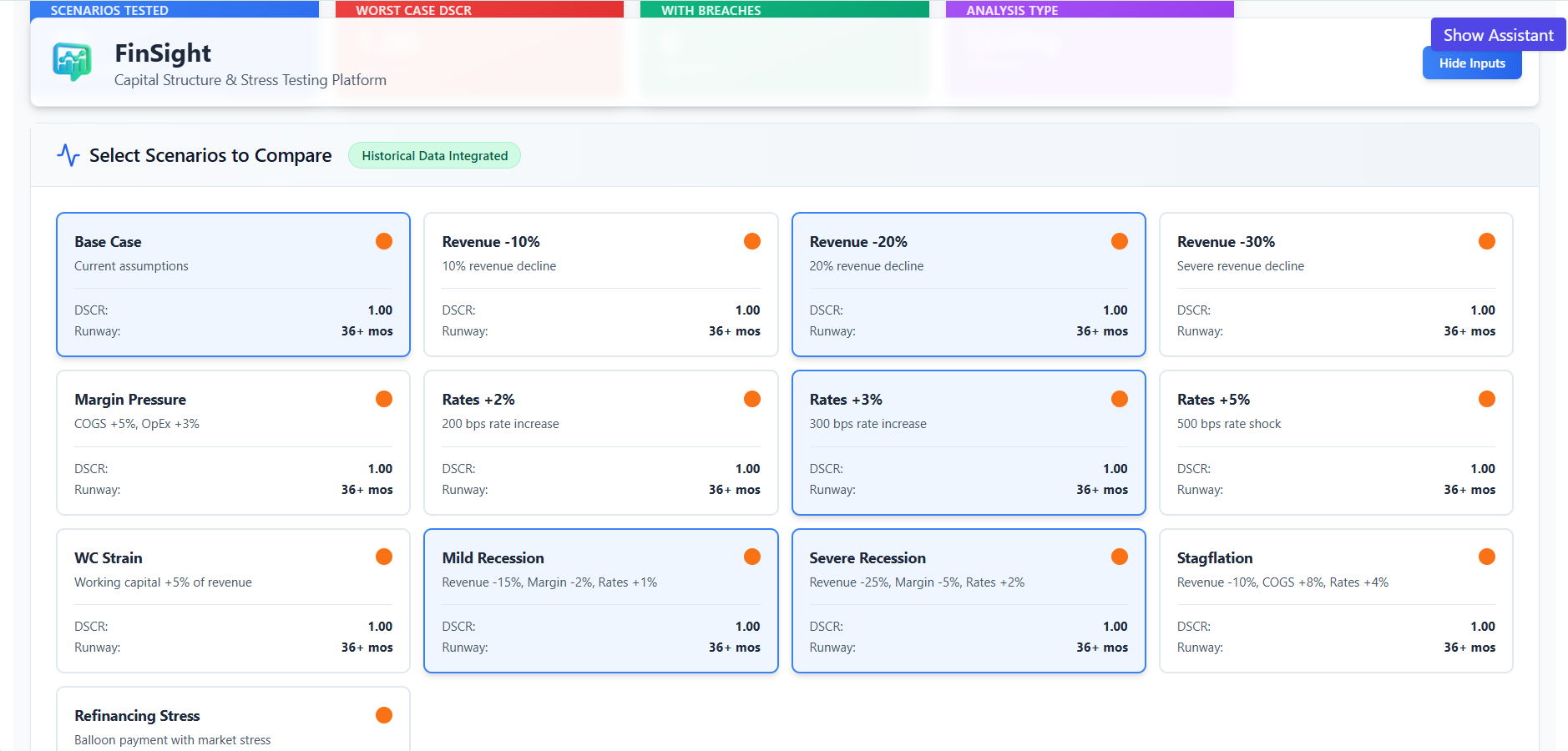

Run simultaneous sensitivity analysis across recession scenarios, cost inflation, and rate shocks. Identify covenant breaches before they materialize.

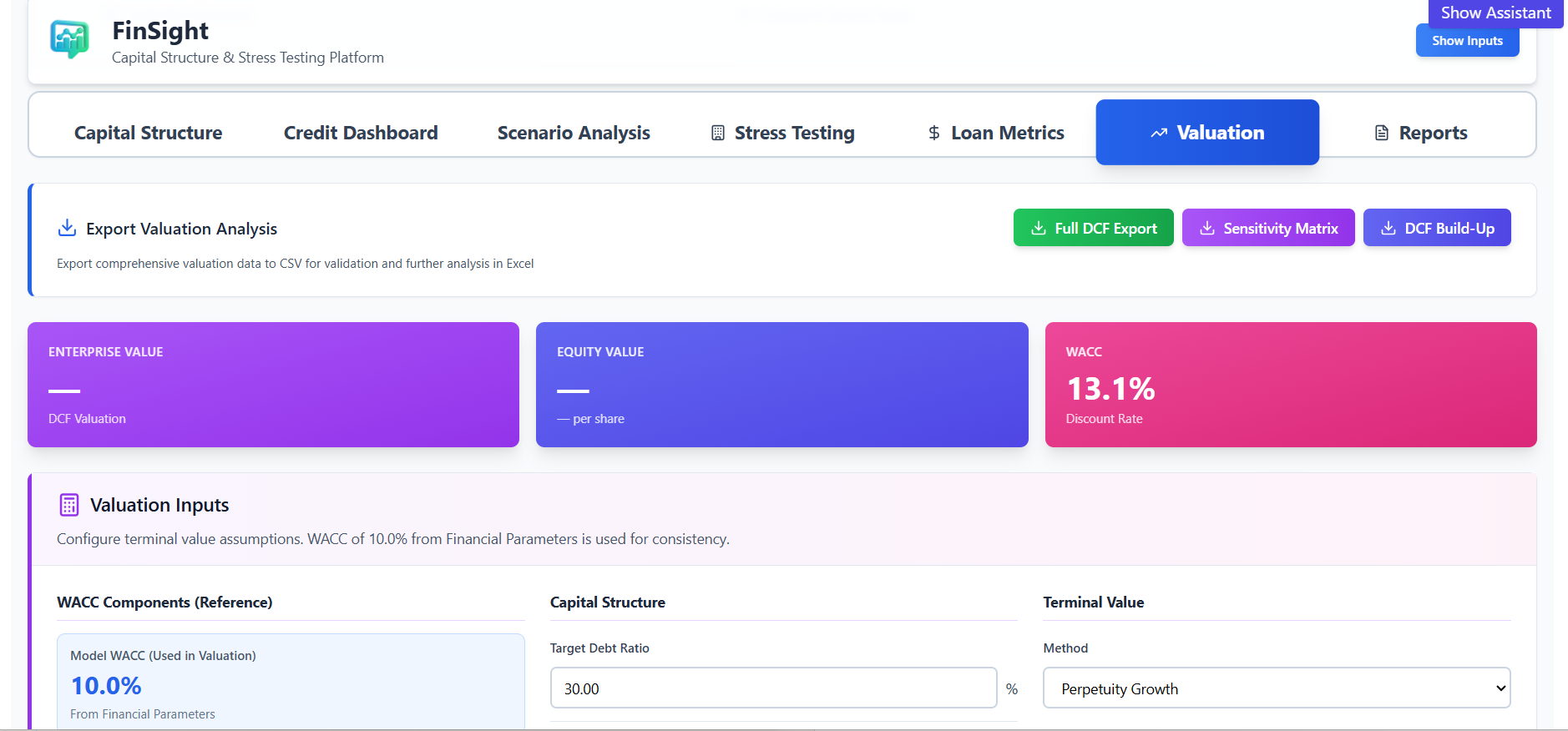

Calculate enterprise and equity values using perpetuity growth or exit multiples. Includes built-in CAPM analysis, WACC optimization, and sensitivity matrices.

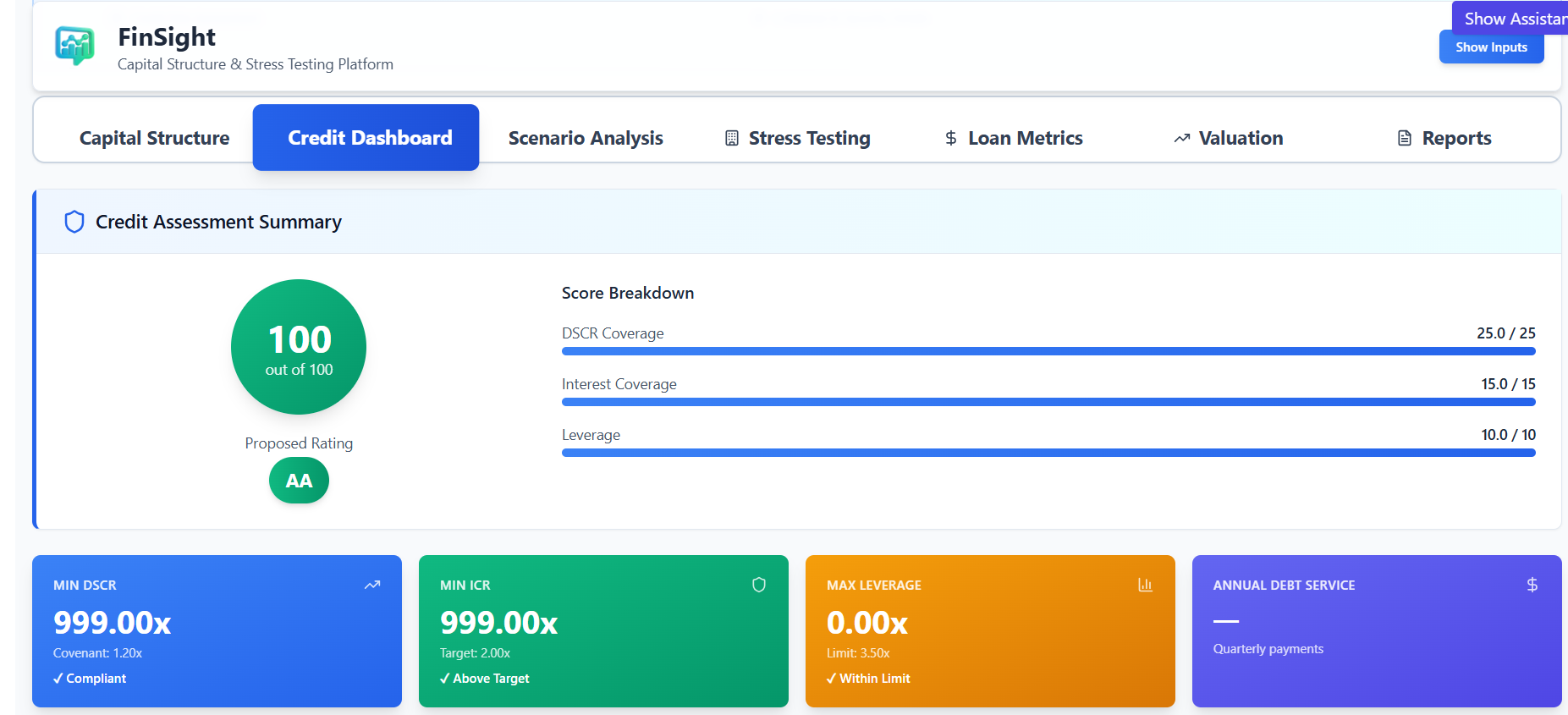

Real-time tracking of DSCR, ICR, and leverage ratios across your entire projection period with automated covenant breach detection and alerts.

Generate board-ready credit memos, executive summaries, and comprehensive deal books. Export to PDF or CSV with full audit trails.

Model any debt structure including term loans, revolving credit, bonds, balloon payments, interest-only periods, and custom amortization schedules.

Upload years of financial statements and watch FinSight automatically calculate growth rates, margin trends, and key assumptions. Our intelligent engine identifies patterns and suggests realistic projection parameters.

Test your deal against multiple economic scenarios simultaneously. See how covenant ratios perform under recession, inflation, and rate shock scenarios—all updating in real-time as you adjust assumptions.

Built on the same methodologies used by top investment banks. Our DCF engine handles complex capital structures, multiple valuation approaches, and generates sensitivity analysis that stands up to board-level scrutiny.

Purpose-built solutions for the teams structuring and analyzing debt transactions every day

Underwrite loans faster with automated credit analysis, covenant testing, and comprehensive stress scenarios. Close more deals with confidence in your risk assessment.

Structure complex debt deals with enterprise-grade DCF and multi-scenario analysis. Deliver client-ready materials faster while maintaining institutional quality standards.

Evaluate LBO opportunities with integrated returns analysis (IRR, MOIC) and detailed debt capacity modeling. Model exit scenarios and sensitivity in minutes.

Build board-ready financial models without specialized Excel expertise. Present capital structure decisions with confidence using professional-grade analysis.

See how teams are transforming their deal workflows with FinSight

"FinSight reduced our underwriting time from 3 days to 4 hours. The automated covenant testing alone has saved us countless hours and caught issues we would have missed."

"The DCF engine is as sophisticated as what we built in-house at my previous investment bank, but without the maintenance headache. Game-changer for our team."

"Finally, a platform that understands how lenders actually work. The stress testing features have completely transformed how we present deals to our credit committee."

Request a personalized demo and discover how FinSight can transform your debt structuring workflow

Join leading financial institutions using FinSight

Join hundreds of analysts who've accelerated their workflow by 10x